01 August 2017

Late payment is a huge problem for many small businesses. When customers don’t pay on time this racks up aged debts, eats into your business time as you chase late payers and puts a big dent in your cash-flow forecasts. But using the latest payment technology gets you paid faster, more efficiently and back in control of your invoice payments.

37% of UK small businesses run into cash-flow difficulties because of late payment issues – and 20% cite a slowdown in their profit growth, according to recent research by the Federation of Small Businesses. If your company is going to stay profitable, it’s vital to speed up payments, and keep your cash flow positive.

In the first of this two-part series on improving bad debts, we’ll look at how financial technology, and the power of automation, make it easier than ever to stay on top of cash collection and keep late payments to a minimum.

Cash flow is the lifeblood of your business – if you don’t get paid on time, that blood stops pumping around your business and you’ll soon find yourself on life support.

But cash flow is utterly reliant on the business having a stable pipeline of income. If hurdles are put in the way of efficient payment, that causes a multitude of problems for the financial health of the company.

Common payment challenges include:

So how do you overcome these payment hurdles and make sure the cash keeps rolling in?

The way you get paid will vary depending on the industry you trade in, whether you’re a business-to-business (B2B) or business-to-consumer (B2C) enterprise, or where you do business – whether it’s from a retail outlet or through an online eCommerce website.

But as payment technology has evolved, some of the traditional methods of payment are beginning to seem outmoded and inefficient in a 21st century marketplace.

To highlight just a few examples:

So, what payment options are open to the modern small business owner? How can you quickly, simply and inexpensively choose a payment approach that works for your customers – and that keeps your cash pipeline flowing without any hassles?

Using payment gateways, cashless methods and modern Direct Debit solutions help you to scale down the late payment issue and make the whole payment process faster, easier and more connected to your wider business systems.

If you’re a business that deals face-to-face with consumers (retail, hospitality etc) you need the easiest possible way to take payment there and then, in person. Card readers and the associated online apps that power them make this incredibly simple.

Card reader systems like iZettle plug into your iPad or smartphone and lets you take card payments in an instant. And because they’re connected to your accounts system in the cloud, all your transactions are instantly accounted for and can be reconciled with the live bank feed in your Xero online accounting system.

If you’re running a service-based business, where you send regular or ad-hoc invoices to customers, there are a range of payment technology options to do this.

PayPal is a popular option for consumers, and gives your customers a way to pay you online with minimal hassle, and a system like Stripe will let you take card payments online in a similarly simple and straightforward way.

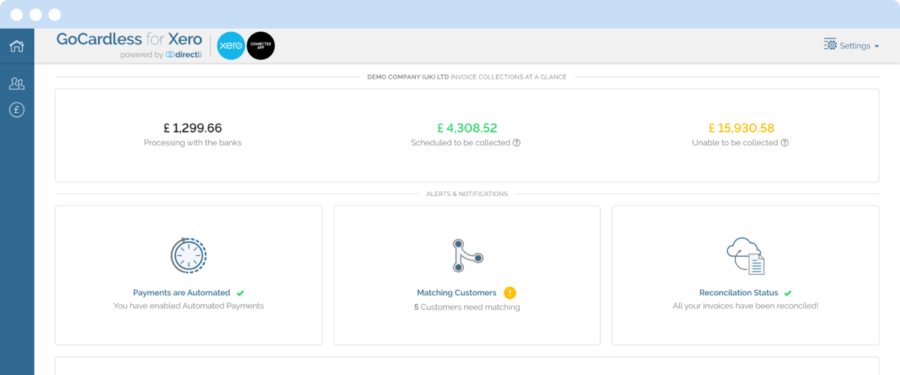

GoCardless is the payment solution that changes the game for business users, in our opinion. Based around the existing Direct Debit system, it takes a well-established method of payment and brings it kicking and screaming into the 21st century.

So why is automating your cash collection through GoCardless such a game changer?

Our MD, Jonathan Gaunt, explains how moving to GoCardless not only changed how we work as a practice, but also gives every small business a way to get in real control of their late payments and remove the pain of chasing up bad debts.

Are you struggling with late payments, time-consuming credit control duties and poor cash flow? If you are, now’s the time to start getting proactive about a better approach to payment, cash collection and your underlying financial management.

With so many payment technology options out there, the ideal digital payment set-up for the job is only a few clicks away – whatever sector you’re working in.

So, dive into the world of payment technology, and start looking for ways to streamline and automate those payment methods.

In part two, we’ll be looking at the best ways to manage your aged debts, and how automated credit control apps streamline the whole process of chasing late payment.

As an accountancy firm we take a different approach to finance. Our team of accountants, advisors and Xero experts work with progressive businesses across Bristol, Bath and the wider South West. We help our clients get a handle on their finances and make bold business decisions.

Want to get your cash collection automated? Talk to us about setting up GoCardless.

Call us now