29 May 2018

Cash flow is the lifeblood of any business. But poor cash flow is still a key financial concern for the UK’s start-ups, as well as more established small and medium-sized businesses (SMBs). So how do you go about promoting positive cash flow?

52.1% of UK SMBs are in a positive cash-flow position according to figures for March 2018 from Xero’s Small Business Insights page, but that still leaves nearly half of the UK’s SMBs struggling to make their cash work for them effectively.

To combat this, it’s vital to get in control of your cash flow and set solid foundations for your financial model – giving you the stability and confidence to invest money back into the company and provide the funds for expanding and growing the business.

We’ve highlighted 5 simple steps that will help you get proactive about your cash flow, with hints and tips for achieving positive cash flow throughout the business cycle.

Cash flow is all about maintaining a positive balance between your cash inflows (money coming into the company) and cash outflows (the money going out of the business).

As such, cash flow is a process, not a static number. So to stay on top of cash flow, it’s vital that you have a view of your cash and working capital that’s as current and up to date as possible.

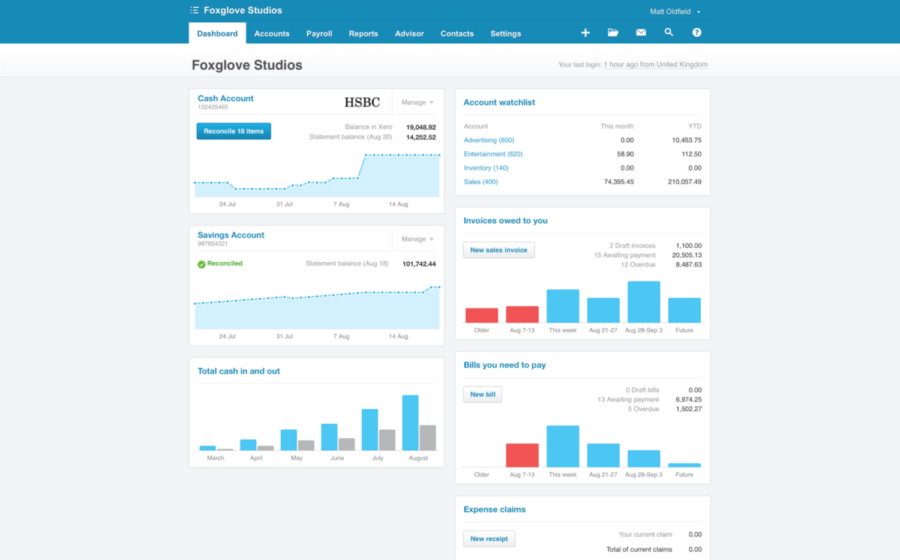

Managing your finances with Xero online accounting software brings you some of the key financial numbers you need – all shown as real-time information. Looking at your main Xero Dashboard brings you the critical financial information and key performance indicators (KPIs) relating to your financial position – helping you manage the twists and turns of the cash pipeline.

And there’s a wide range of plug-in Xero cash-flow apps, such as Float or Fluidly, that take your real-time Xero numbers and provide a full drilled-down cash-flow management tool.

Get to grips with Xero and:

37% of UK SMBs have experienced the negative impact of late payment on their overall financial health. The longer it takes your customers to pay, the less ready cash you have in the business and the harder it becomes to cover your costs and trade successfully.

Changing to a more efficient payment method speeds up payment times. By removing the barriers and making payment as simple as possible, your customers can often pay you with a simple click of a button – and that’s good news for your cash flow!

To get paid quicker:

Figures show the average SMB is owed £63,881 in late payments, and that level of aged debt will have a hugely negative impact on the overall cash position of the business.

The bigger your debtor day number (the time it takes the average customer to pay you) the longer it will take to get paid and the harder it will be to maintain a steady and reliable pipeline of income into the business. So clawing back your outstanding payments, and getting that cash back in the kitty, is vital to good cash-flow management.

To reduce those outstanding debts:

Good debtor tracking and credit control helps to speed up those late payments – reducing your aged debt and giving your overall operating cash flow a healthy boost.

Financial modelling is an important way to understand cash flow. The efficiency of your financial model is directly linked to how effectively you can manage your cash flow. So the deeper you can drill into your financial model, the more control you have over cash.

When you understand the drivers in your business – areas like operating costs, staff expenses and forecasted sales – you increase your ability to manage your cash position successfully.

To get financial modelling working for you:

Cash flow can get complex – especially when it comes to running three-way cash-flow forecasts or running cash projections as part of a financial modelling process. That’s why there’s real value in working closely with your accountant when it come to cash-flow management.

Partnering with an experienced business adviser adds real value, bringing you a more detailed and forward-looking view of your cash flow. That’s vitally important when it comes to managing your cash effectively and sidestepping any shortfalls.

To improve your overall view of your cash position:

The financial road can be a rocky one, but with an trusted adviser in the co-driver’s seat you can stick to the most sensible route and keep your cash flowing effectively.

Cash flow isn’t something that will take care of itself – to maintain positive cash flow requires planning, proactive action and a keen eye on your financial numbers.

When you follow these 5 key steps, a lot of that hard work will be reduced:

With solid financial foundations and processes in place, there’s no reason why your business can’t enjoy long-term positive cash flow, with the ready cash needed to fund your growth and expansion plans.

Established in 2013, we’re a firm of accountants, business advisors and Xero specialists based in Bristol and Bath. We help those we work with identify the drivers for growth and empower business owners to make bold decisions.

If you’re aiming to achieve a positive cash-flow position, we can help

Get in touch