17 October 2017

One of the key benefits of Xero online accounting is the way you can customise the coding, functionality and reporting to meet the exact needs of your business. But how do you tailor the codes in your Xero accounts – and what’s the key benefit of this?

As any business using Xero online accounting will tell you, it’s a brilliant piece of software for getting real-time control over your finances, key numbers and reporting. But to realise the true benefit of this functionality, you’ve got to get your hands dirty and start tailoring the Chart of Accounts and accounting codes in Xero.

So, what exactly is a ‘Chart of Accounts’? And how can you amend, update and customise the Xero codes it contains to create a truly bespoke way to manage your finances?

At the centre of your Xero system is something accountants refer to as the ‘Chart of Accounts’ – a full list of all the codes used within your accounts.

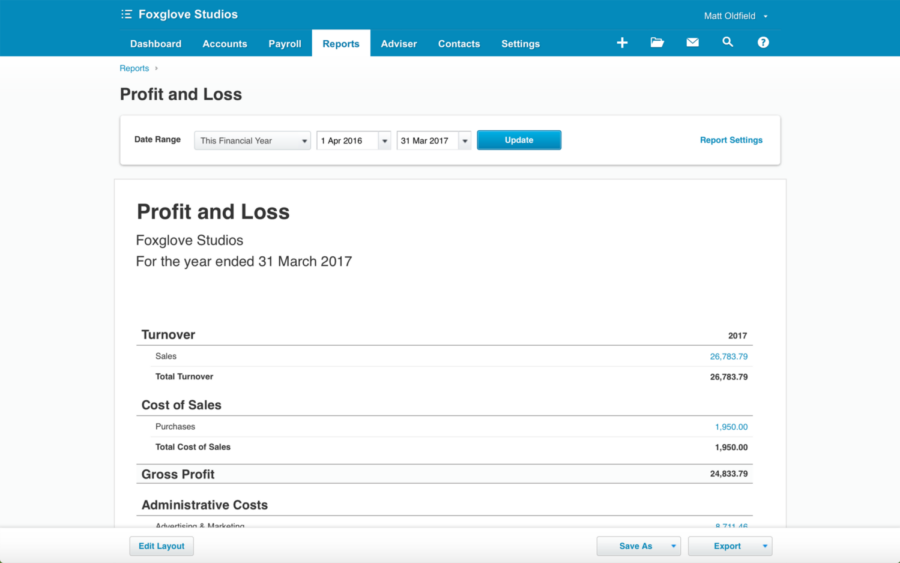

The Chart of Accounts uses numerical codes to track every incoming and outgoing transaction you carry out in the business. For example, ‘Sales’ are coded against the 200 code, ‘General Expenses’ are logged under the 429 code and ‘Printing & Stationery’ is assigned to the 461 code. It’s a way to codify your costs and income so you can make more sense of them.

Xero’s getting smarter and smarter about automating the choice of codes when doing your bookkeeping, but deciding how to break down your transactions, what codes to use and how you’ll then customise your Chart of Accounts is something that requires a human touch.

The Chart of Accounts is the underlying heart of Xero, and by customising your account codes to the precise needs of your business you can record and track each element of your finances.

In essence, this coding process allows you to tag and group every single cost or revenue item in the business. By putting each transaction into its own unique ‘pot’, you can then quickly and easily tally up the contents of each pot and see how much money’s been made, or spent.

The standard Chart of Accounts in Xero will get you off to a good start, but tailoring the codes to track the key numbers in your specific business model gives you a far more detailed (and more tailored) overview of the company’s finances.

Amending your Xero codes so they’re more suited to the needs of the business makes a lot of sense, and adds real value to your Xero reporting.

It could be something as simple as changing the name of an existing code to the preferred term you use in your business, or it could be that you want to create new sales codes for each individual branch in your company, or every sales person in the team.

If you’re happy to get a little ‘hands on’ with the internal workings of Xero, it’s possible to amend or create these codes yourself.

Here’s a quick overview of the main ways to amend your codes:

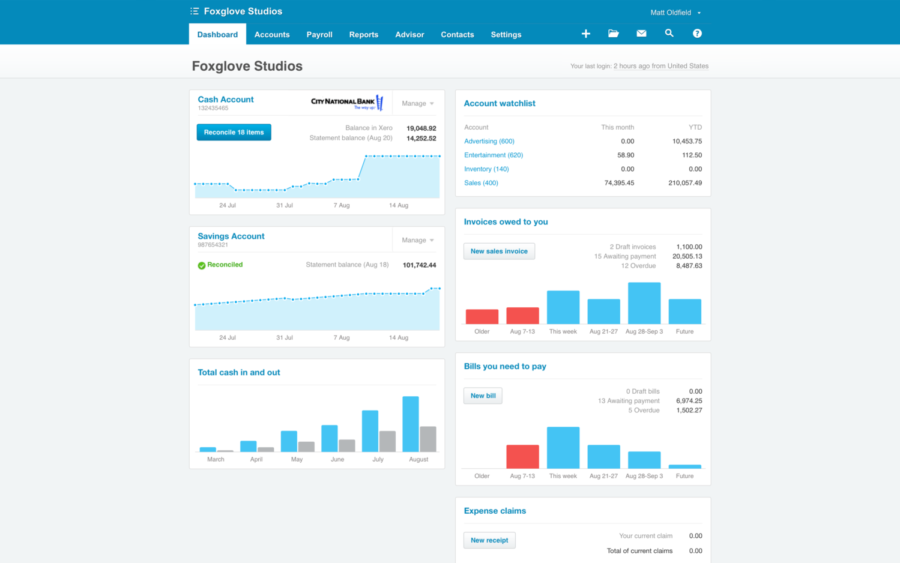

With your Xero codes customised and tailored to your exact needs, you have a powerful set of tools in Xero for tracking performance over time and highlighting the key financial areas where action or improvements may be needed.

Your profit & loss (P&L) and balance sheet reports will show you each account code as a separate breakdown in your reporting, with the option to compare against previous months, periods or years. And you can even customise your main Xero Dashboard to show the important numbers, metrics and KPIs that you’ve set up as new codes.

By making it easy to track the numbers that matter, you get an instant, real-time overview of the health of the business. And that’s a huge advantage when it comes to managing your finances, planning your future months’ activity and making important business decisions.

If you’d like any help with customising your Chart of Accounts and Xero codes, we’re always at the end of the phone line.

Talk to us about new ways to customise your Xero set-up with enhanced coding and tracking. We’ll help you to improve your scorekeeping and performance management, and will provide you with the important numbers you need for managing the business.

The FD Works team of accountants are here to help you to get control of your financial destiny and achieve your key goals. From our Bristol and Bath offices our team help startups, scaleups and established firms throughout the South West and across the UK embrace their numbers and succeed.

We tailor your Xero codes to the requirements of your business

Call us to arrange a meeting